Changing landscape

The UK renewables market is undergoing a fundamental shift from a Government subsidy regime to a self-funded or even privately funded commercial proposition. Against the backdrop of political uncertainty, changes to renewable subsidies and falls in wholesale energy prices that occurred last year, the industry is showing signs of resilience with rapid growth in independent energy generation, carbon reduction and energy efficiency projects backed by private and institutional investors.

Relevance of energy efficiency

According to McKinsey & Company, energy efficiency, which is sometimes called the “fifth fuel” (after coal, gas, nuclear, and renewables), can play an important role in helping the world meet its demand for power and mobility. Their research shows that while operational improvements can reduce energy consumption by 10 to 20%, investment in energy-efficiency technologies can boost that to 50% or more.

Private investment

According to a report from SmartestEnergy, total investment in the independent energy sector rose to almost £2.1bn, with more than 4,460 commercial-scale sites in operation. The independent renewable energy projects generated an estimated £1.08bn of energy each year, enough to power around 5.7m UK homes.

PWC estimates that in order to reach the UK’s 2020 targets (based on government’s deployment forecasts), electricity is expected to attract the main share of the capital (£40.8bn), followed by renewable heat (£23.6bn).

Public demand for investments that make money is so great that the market is on course to grow to £11bn by 2020, involving nearly four million people (Source: Ethex).

“The ESCO business model permits an energy user to install new energy generation or energy efficiency equipment without undertaking any upfront capital investment”

Change of tactics

Anybody following this sector over the last five years would have noticed that the UK Government is clearly in a mood to withdraw subsidies for the renewable energy sector – for example, Solar PV subsidies will shortly be reduced by 85%. The Government is clearly trying to curry favour with the public by reducing energy costs by minimising or removing the green energy tax in the future, but the reality is that the burden is passing to the private business sector as the strategy is now one of stick rather than carrot.

As part of the EU directive, the Government has introduced ESOS recently which is an audit of a large part of the business community aimed at monitoring the carbon emissions and introducing fines for failure to undertake audits with the express view of forcing the companies to reduce carbon emissions by upgrading current heating, lighting and air conditioning equipment to reduce carbon emissions. The ESOS came into force last year and an audit of energy usage in buildings, transport and industrial operations becomes mandatory for all companies with over 250 employees or an annual turnover in excess of £42.5m from the end of 2015.

Energy efficiency investments provide value for money both for corporates, as well as the Government. An analysis of Government Impact Assessments by Frontier Economics shows that they have comparable benefits to other major infrastructure investments. In fact, a programme to make British buildings more energy efficient would generate £8.7bn of net benefits. This is comparable to benefits delivered by the first phase of HS2, Crossrail, smart meter roll out or investment in new roads. This finding holds, even without quantifying other social benefits of energy efficiency measures (for example, health and wellbeing improvements).

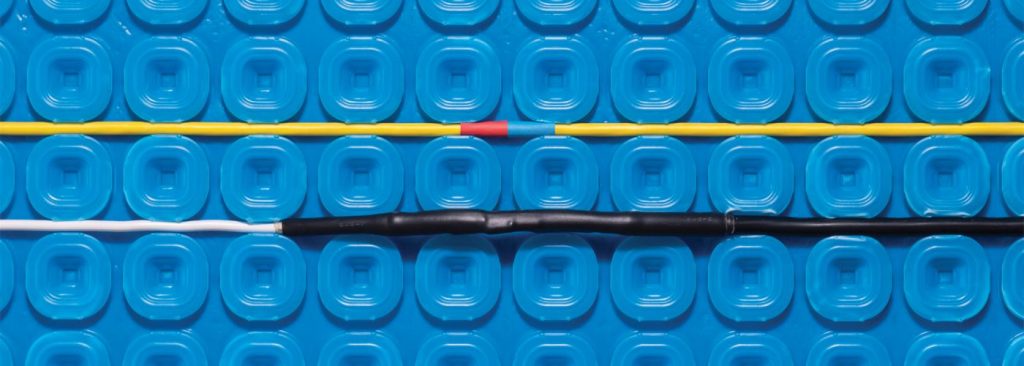

One such example of efficient technology is LED lighting. An LED is a semiconductor light source used in various applications such as general lighting, backlighting and automotive lighting. LEDs are used in exterior, as well as interior lighting. LEDs are gaining acceptance because of their efficiency and low cost. LEDs also enhance safety and offer an aesthetic appeal. They are environment-friendly as they reduce energy consumption by 40~50 %. In a nut shell, LED lamps reduce energy costs and save maintenance bills against traditional bulbs.

The LED lighting market in the UK is currently experiencing an explosion in growth as the new technology becomes more widely accepted in the mainstream lighting market, further encouraged by energy cost savings and CO2 concerns, driven by legislative changes.

Market drivers

LED technology has developed rapidly over the last five years. From a position where the upfront costs were prohibitively expensive and the savings were not enough to justify the investment, the installation costs have now reduced dramatically with the size and reliability of savings significantly improved. These savings have been further enhanced by the rising cost of energy, another significant driver of LED uptake.

A significant proportion of the market is also been driven by the EU Energy Efficiency Directive – which is being implemented in the UK through the Energy Savings Opportunity Scheme (ESOS). These factors have vastly increased the range of financial viable projects and mean that businesses and individuals are keener to embrace the technology more rapidly.

Corporates are taking the lead on the basis of commercial interests, compliance measures as well as the sustainability aspect. Businesses intend to control cost and become greener, meaning that an increasing number of businesses are taking a strategic approach to LED projects.

Lack of available funding to cover the initial costs of converting to LED technology has been a significant barrier (and continues to be) to starting sizable projects and investment in renewable energy, heat or energy efficiency equipment.

Solution – ESCO model

The ESCO business model (the acronym stands for either Energy Services Company or Energy Savings Company) permits an energy user to install new energy generation or energy efficiency equipment without undertaking any upfront capital investment.

The ESCO model typically involves an ‘off-balance sheet’ financing vehicle (SPV), which owns and manages the equipment or the energy efficiency installations connected to a building /buildings. The resulting savings in energy use reduce costs for the energy user and provide a return to the investors in the SPV and ultimately pays back their original investment, even after management fees.

Model working

An ESCO is a company that provides energy efficiency services, where performance contracting is a core part of its business. This means that payments are based on the performance of the equipment and services, particularly in relation to energy savings.

The client directly leverages the savings from making the improvements and pays SESCO a fee over the contracted period, keeping the rest of the savings. Therefore, this is a savings based repayment model which is viable when the savings are sufficient to meet the ongoing finance costs.

It is a fully funded LED project – with integrated supply chain management to procure LED bulbs, install, manage and maintain the project over the contracted period.

The ESCO manages the financing process, sourcing investment to finance the purchase of the equipment on behalf of its client, and it manages the SPV throughout its lifetime (which ranges between seven and 20 years depending upon the technology installed).

Advantages include:

- Specialist expertise is harnessed to manage and undertake the range of activities on the project.

- The client does not need to raise the initial finance meaning its finance can be spent elsewhere or where there is significant budgetary pressure on the procurer, this route allows them to undertake the investment.

- The contractor assumes much of the risk over the costs of installation, maintenance and the performance risk of the equipment.

- The contractor is incentivised to install the lowest cost option on a whole life basis, taking account of maintenance and replacement costs and energy savings produced. This can often generate cost savings and helps to ensure poor quality items are not installed.

- Funder pays for the level of service provided, which means the contractor has a strong incentive to manage the project effectively.

- At the end of the contracted period, energy savings outweigh the ongoing cost of the contract, enabling the client to keep the entire savings.

Hence, businesses need to meet energy demand in a way that is both economically and environmentally efficient. Efficient technologies could significantly reduce energy consumption and save industry more than £380bn a year (Source: McKinsey & Company).

Given the recent shift in government policy from subsidy to compliance, renewables projects which are privately funded can meet the business interests and deliver a “positive impact” – beneficial for both society and the environment – a win-win situation for all stakeholders.