Weather-related weakness slows construction product manufacturing in Q1

The Construction Products Association’s (CPA) State of Trade Survey for 2018 Q1 shows that the £56 billion UK construction products manufacturing industry suffered a weak start to 2018, in a quarter that combined the liquidation of Carillion and several days of disrupted activity due to snow and freezing temperatures.

The Construction Products Association’s (CPA) State of Trade Survey for 2018 Q1 shows that the £56 billion UK construction products manufacturing industry suffered a weak start to 2018, in a quarter that combined the liquidation of Carillion and several days of disrupted activity due to snow and freezing temperatures.

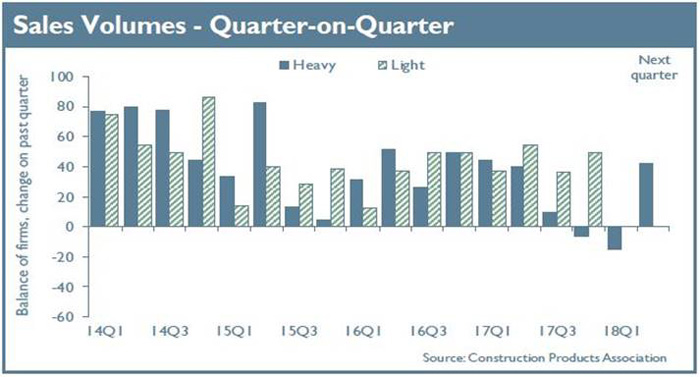

Heavy side manufacturers recorded the lowest balance in five years with 15% of firms reporting a decline in sales in Q1, following a previous quarter of falling sales in 2017 Q4. For light side manufacturers, no firms on balance reported either an increase or a decrease, which was the weakest performance since 2013 Q2. Construction product sales act as an early indicator of wider construction activity and these results signal a noticeable dip in total industry output for Q1.

Manufacturers anticipate a return to growth in the coming quarters, but rising costs continue to act as a headwind. Ninety percent of heavy side manufacturers and 84% of those on the light side reported a rise in raw materials costs in Q1, whilst the same proportions reported an increase in wages and salaries. In addition, fuel costs rose for 90% of heavy side manufacturers.

Rebecca Larkin, CPA senior economist, said: “It was always unlikely that heavy side manufacturers would avoid the snow disruption, with aggregates quarries unable to operate and pauses in activities such as groundworks and bricklaying affecting demand for products and materials from construction sites. In addition, manufacturing capacity in this energy-intensive sector of the industry is likely to have been temporarily reduced by the National Grid’s gas deficit warning at the beginning of March.

“It appears from the forward-looking indicators that Q1 was just a weather-related blip, as 42% of heavy side manufacturers anticipate sales rising in Q2 and 37% see sales rising over the next 12 months. However, no light side manufacturers expect sales to increase in the next quarter and only 16% anticipate a rise over the course of the year, likely to reflect the lagged impact of any pauses in activity in Q1 on demand for these non-structural and finishing products that tend to be used nearer the end of the building process.”

Key survey findings include:

- A balance of 15% of heavy side firms reported that construction product sales fell in the first quarter of 2018 compared with the fourth quarter of 2017. No light side firms, on balance, reported a rise in sales in Q1

- On an annual basis, sales decreased for 5% of heavy side firms but rose for 10% of firms on the light side, on balance

- On balance, 37% of heavy side manufacturers anticipated a rise in sales in the next year, increasing from a zero balance in the previous quarter

- On the light side, 16% of firms expected an increase in product sales in the next year, compared to a balance of 10% in 2017 Q4

- Annual cost increases were reported by 90% of manufacturers on the heavy side and 79% on the light side

- Raw materials costs rose according to 90% of heavy side manufacturers and 84% of those on the light side

- Sixty-eight percent of heavy side manufacturers and 67% of light side manufacturers anticipate a rise in costs over the next 12 months.