Construction output growth reaches seven-month high in June

June data revealed a solid expansion of overall construction activity, underpinned by greater residential work and a faster upturn in commercial building. There were also positive signs regarding the near-term outlook for growth, as signalled by the strongest rise in new orders since May 2017 and the largest upturn in input buying for two-and-a-half years. Improved demand for construction materials resulted in longer lead times from suppliers and the most marked increase in input prices since September 2017.

June data revealed a solid expansion of overall construction activity, underpinned by greater residential work and a faster upturn in commercial building. There were also positive signs regarding the near-term outlook for growth, as signalled by the strongest rise in new orders since May 2017 and the largest upturn in input buying for two-and-a-half years. Improved demand for construction materials resulted in longer lead times from suppliers and the most marked increase in input prices since September 2017.

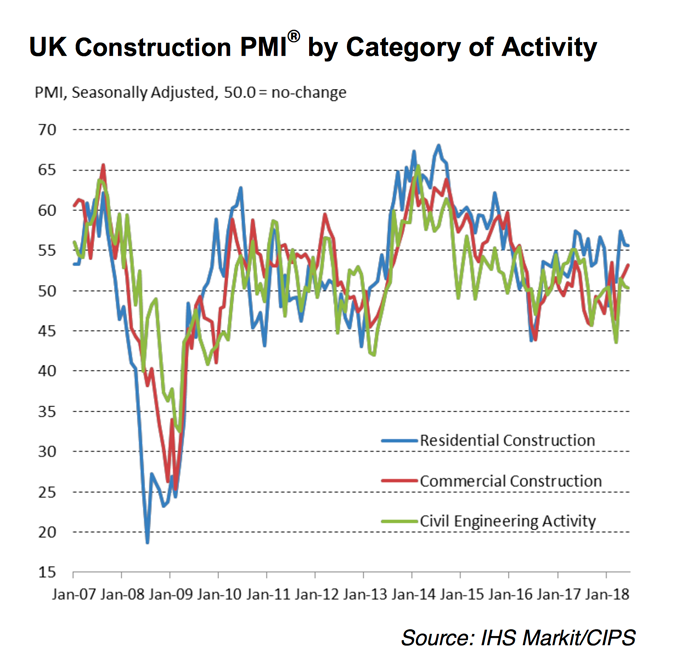

The seasonally adjusted IHS Markit/CIPS UK Construction Purchasing Managers’ Index (PMI) posted 53.1 in June, up from 52.5 in May and above the 50.0 no-change value for the third month running. The latest reading pointed to the sharpest overall rise in construction output since November 2017.

Residential work remained the best performing area of activity. Commercial building also contributed to the stronger overall rise in construction output, with this category of work expanding at the fastest pace since February. At the other end of the scale, civil engineering activity rose only slightly in June, with the rate of growth easing to a three-month low.

Survey respondents noted that a general improvement in client demand had helped to boost construction workloads in June. Reflecting this, latest data indicated a solid rebound in new order volumes following the decline seen during the previous month. The rate of new business growth was the strongest for just over one year in June.

Higher levels of new work contributed to faster increases in employment numbers and purchasing activity during June. The pace of job creation accelerated to its strongest for one year, while the latest rise in input buying was the steepest since December 2015. Construction companies noted that greater purchasing activity reflected new projects starts and, in some cases, forward purchasing of inputs to mitigate forthcoming price rises from suppliers.

Average cost burdens increased at a sharp and accelerated pace in June. The latest increase in input prices was the steepest for nine months, which construction companies attributed to greater transportation costs and higher prices for metals (especially steel). Meanwhile, vendor lead times lengthened again in June, driven by low stocks and capacity constraints among suppliers.

UK construction companies indicated a rebound in business optimism from May’s seven-month low, although the degree of positive sentiment remained much weaker than the long-run survey average. Survey respondents cited infrastructure work as a key source of growth in the coming 12 months.

Comments

Tim Moore, associate director at IHS Markit and author of the IHS Markit/CIPS Construction PMI, said: “The latest increase in UK construction output marks three months of sustained recovery from the snow-related disruption seen back in March. A solid contribution from housebuilding helped to drive up overall construction activity in June, while a lack of new work to replace completed civil engineering projects continued to hold back growth.

“Of the three main categories of construction work, commercial building was sandwiched in the middle of the performance table during June. Survey respondents suggested that improved opportunities for industrial and distribution work were the main bright spots, which helped to offset some of the slow-down in retail and office development.

“Stretched supply chains and stronger input buying resulted in longer delivery times for construction materials during June. At the same time, higher transportation costs and rising prices for steel- related inputs led to the fastest increase in cost burdens across the construction sector since September 2017.”

Duncan Brock, group director at the Chartered Institute of Procurement & Supply, said: “With the fastest rise in new orders since May 2017, it appears the brakes are off for the construction sector. Despite being hampered by economic uncertainty, firms reported an improved pipeline of work as clients committed to projects and hesitancy was swept away.

“Input prices were a challenge with the biggest inflationary rise since September 2017, so the pressure was on to build up stocks of materials rising in price and becoming more scarce. This resulted in a heavy impact on suppliers unable to keep pace as deliveries became laboured and purchasing managers were at their busiest for two and a half years.

“Housing continued on its positive trajectory for a fifth month and commercial activity also improved after a weak start to the second quarter. However, before we bring out the bunting, the sector is not out of the woods yet and there needs to be further sustainable activity to be convincing. A cloud of uncertainty remains, given the sector’s hit and miss performance so far this year and lower than average business confidence in June.”