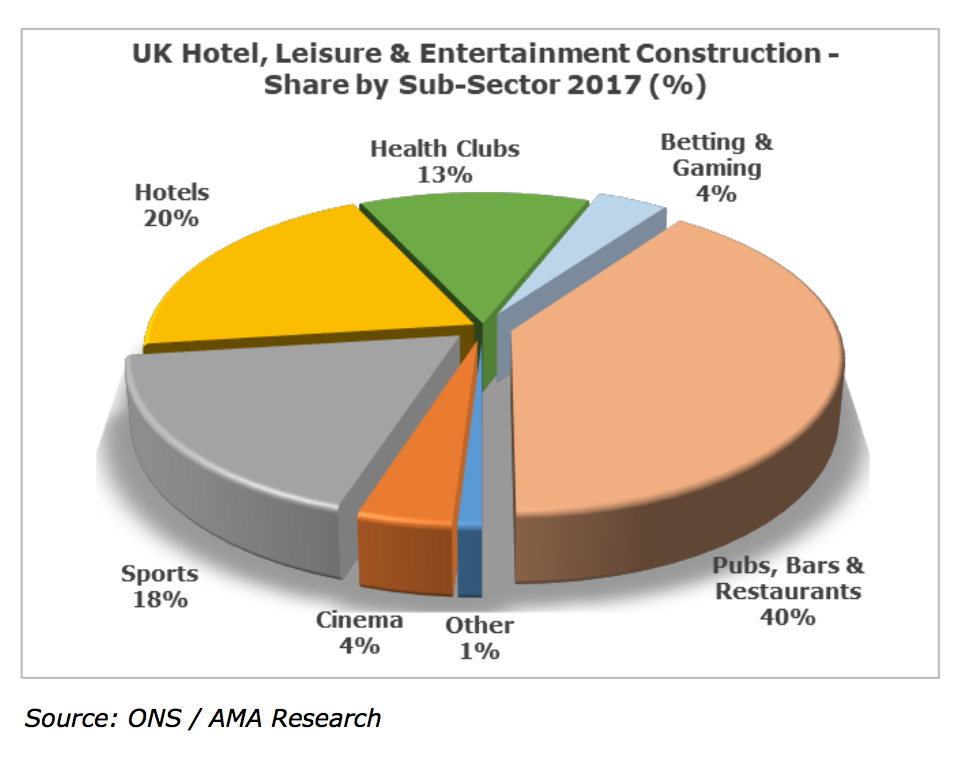

Hotel, leisure and entertainment construction output grew by 33% in 2017

Dominated by the private sector, the entertainment and leisure sector has experienced more positive construction output conditions than many other sectors over the past five years. Despite a dip in 2015, output growth in the sector has remained between 2013 and 2017, and overall indications are that output grew by around 33% in 2017 to reach £9.4bn. Expansion and investment has been largely confined to the budget hotels, health and fitness and more recently the cinema segments, with less buoyant activity in other sectors.

Going forward, there is a good pipeline of leisure sector work forecast, with a mix of theme park, resort, hotel and sports stadia in the pipeline, which should underpin construction growth over the forecast period. In addition, there are also a number of projects currently proposed or under discussion for the refurbishment and redevelopment of a number of sporting venues/stadia, with the larger projects likely to make a significant contribution to entertainment output into the medium-term.

The hotel sector will provide significant impetus for output growth into the medium-term with the budget hotel sector a key driver of investment activity. The current erosion of the Pound Sterling against other currencies is making the UK an attractive holiday resort, and underpinning investment in hotels and restaurants, whilst the health and fitness sector should also continue to underpin output growth with the budget gym sector continuing to grow.

However, there are sub-sectors within entertainment that are likely to do less well into the medium-term. The public house estate is facing issues of increased rents and falling turnover, and in addition, the betting and gaming sub-sector has also been affected by the move to online games and virtual casinos.

Overall, sector output is forecast to see good overall growth to 2022, albeit at lower growth rates of between 3% and 5% when output is forecast to be around £10.9bn; however, the diversity of the sector means that growth prospects vary considerably between sub-sectors, with recent growth in the budget and high-end hotel and budget gym and restaurant sectors helping to offset the decline in the pubs and clubs’ sectors.

Many new construction projects in the hotel and leisure sectors relate to re-fit or refurbishment as hoteliers and leisure facility owners focus investment in their portfolios through refits, re-branding and refurbishment programmes, rather than newbuild, and as such there remain opportunities for refurbishment and re-branding for the larger hotel and leisure operators.

Keith Taylor, director at AMA Research said: “There is no doubt that the hotel, leisure and entertainment construction sectors have performed very well in 2016 and 2017 compared to many other sectors. However, the 33% increase indicated by the construction output figures was partly caused by a revision of both historical and current ONS figures, and for 2018 we are likely to see more realistic figures for output growth.”