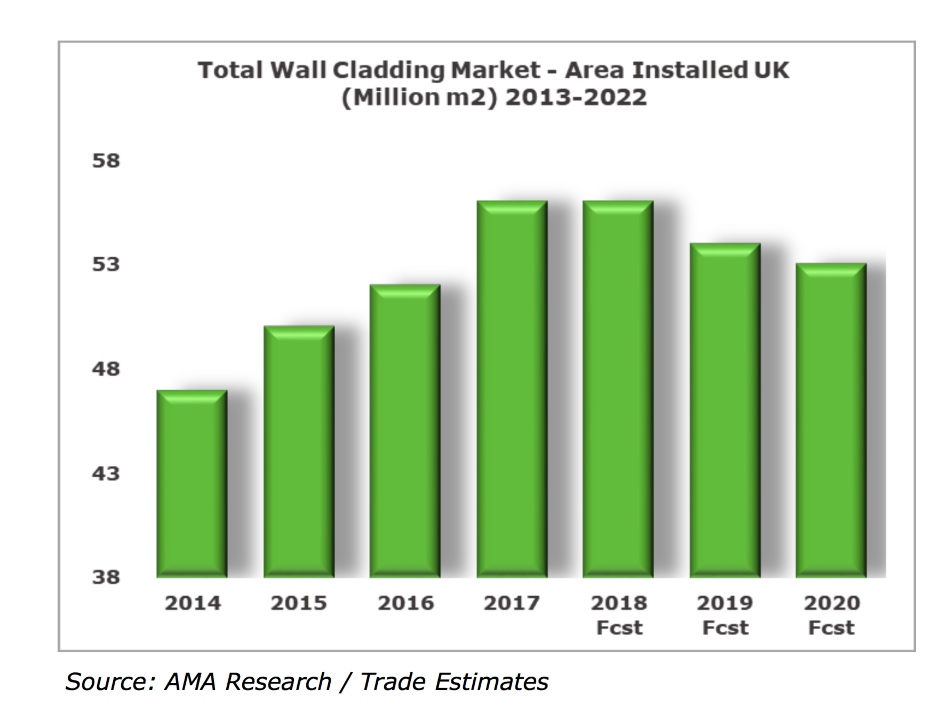

Decline forecast for UK cladding market volumes

The UK market for wall cladding is estimated to have increased by around 40% between 2013 and 2017 in volume terms. In 2017/18, growth has been driven by strong growth in newbuild and major refurbishment output in the broader residential, commercial office, schools and universities, hotels and leisure facilities and warehousing sectors. However, in the retail and healthcare sectors and in certain segments of the leisure market, output levels have either declined or remained static. The forecast for 2018 is also for little to no growth.

Other than the state of the general economy and issues emanating from the ‘Brexit’ negotiations, it is the Grenfell Tower fire in 2017 that could have the greatest impact on the cladding market going forward. A possible ban on the use of combustible materials on buildings over 18m tall may well depress demand for cladding systems comprising rigid polymer insulation, while benefitting those classified as A1 under Euroclass definitions e.g. stone and glass wool, concrete and fibre cement.

While investigations into other high-rise residential towers, with cladding similar to that installed on Grenfell Tower, have revealed that around 500 are similarly vulnerable to rapid fire spread, relatively few buildings have so far had the old ACM cladding replaced. With a number of local authorities and housing associations experiencing severe financial problems, that is unlikely to change in the near future.

Although modest annual economic growth levels are currently forecast to 2020, the medium-term outlook will be dependent upon the path taken to exit the EU and the type of trade and legislative deals formulated. As a result, the view of AMA Research is that demand for cladding will decline. Over the period ending March 2019, at the very least, the uncertainty created by the Brexit situation is said to be likely to create more volatility in the construction market at large, which in turn will lead to a lack of confidence among property investors and business owners.

Other issues include a weakening of sterling against the euro and the US dollar, endemic problems concerning skills shortages in key areas, and the challenges associated with the changes to fire regulations and changed specifications for cladding products.

Other factors that are expected to contribute towards slower growth include the cutting or ending of subsidies for certain products and development programmes. For example, the government’s Energy Company Obligation (ECO) expires next April. A key driver stimulating demand for external wall insulation, it is likely that, as with previous government energy efficiency schemes, once ECO is complete there could be a large drop in demand.