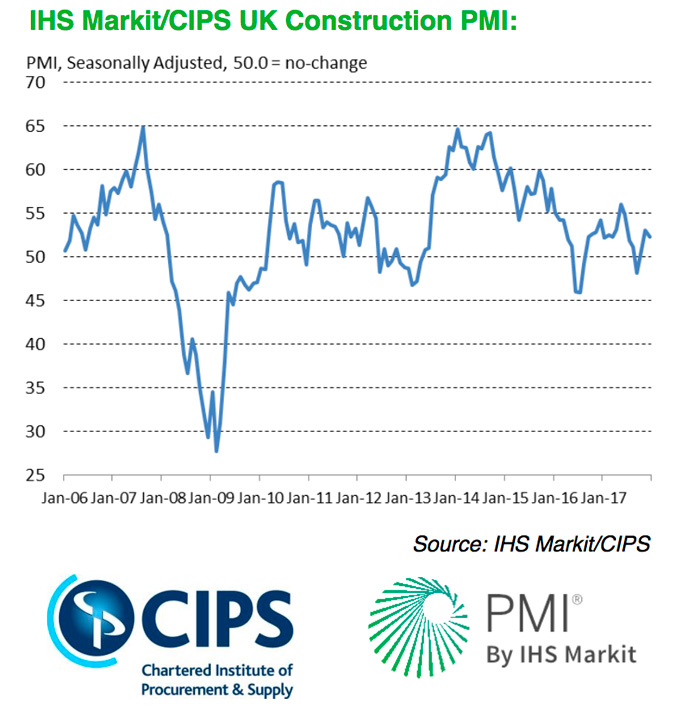

Construction output growth eases slightly in December

UK construction companies indicated an uneven recovery in business activity at the end of 2017. A strong rise in residential building contrasted with falling work on commercial projects and stagnating civil engineering output.

UK construction companies indicated an uneven recovery in business activity at the end of 2017. A strong rise in residential building contrasted with falling work on commercial projects and stagnating civil engineering output.

There were positive signals for the near-term business outlook, with new order growth reaching a seven-month high and job creation the strongest since June.

However, intense supply chain pressures continued across the construction sector, while input cost inflation picked up from November’s 14- month low.

As a result, the latest reading signalled a moderate expansion of overall construction output at the end of 2017.

Survey respondents indicated that house building remained a key engine of growth, with residential work expanding for the sixteenth consecutive month in December. In contrast, latest data indicated a moderate fall in commercial construction, thereby continuing the downward trend seen since July. Civil engineering work stabilised during the latest survey period, which ended a three-month period of decline.

December data pointed to resilient demand for new construction projects, as highlighted by the fastest upturn in new order volumes since May. Anecdotal evidence cited an improved flow of enquires in recent months, alongside a gradual upturn in clients’ willingness to commit to new work.

The prospect of greater workloads ahead resulted in stronger rises in employment and purchasing activity during December. In fact, the latest upturn in input buying was the steepest for two years, which survey respondents widely linked to increased business requirements. Robust demand for construction products and materials contributed to another sharp lengthening of suppliers’ delivery times at the end of 2017.

Strong cost pressures persisted across the construction sector, driven by rising prices for a range of inputs. In particular, survey respondents noted higher prices for blocks, bricks, insulation and roof tiles, alongside continued rises in the cost of imported products. Although the rate of input cost inflation picked up since November, it remained softer than February’s peak. Despite a rebound in new order volumes during December, construction firms indicated a subdued degree of optimism regarding the business outlook for the next 12 months. The balance of companies expecting a rise in output levels remained among the weakest recorded since mid-2013, which survey respondents mainly linked to worries about the wider UK economic outlook.