Infrastructure construction reaches a record low

The value of new construction contracts in March reached £5.3 billion, a monthly increase of 8.7%. However, the overall positivity cannot be shared across all sectors of construction, as infrastructure figures reached their lowest point in March since Barbour ABI began tracking the series.

The value of new construction contracts in March reached £5.3 billion, a monthly increase of 8.7%. However, the overall positivity cannot be shared across all sectors of construction, as infrastructure figures reached their lowest point in March since Barbour ABI began tracking the series.

The latest edition of the Economic & Construction Market Review from industry analysts Barbour ABI highlights levels of construction contract values awarded across Great Britain. Residential housing continues to dominate the construction sector and across March had a total contract value of £2.4 billion, its highest figure for seven months. Conversely, infrastructure contract value decreased by 26% compared with last month, its lowest overall figure since 2010.

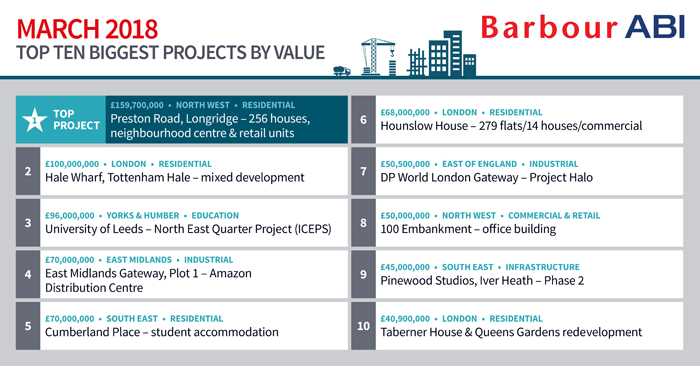

The two biggest projects by value in March were both residential developments, including the Longridge neighbourhood centre which includes 256 houses and valued at over £160 million (see table). There was a distinct lack of infrastructure projects across the top ten biggest projects by value in March, with the sole development the £45 million enabling works of Phase 2 for Pinewood Studios, awarded to Sir Robert McAlpine.

Looking across the rest of the industry, outside of infrastructure every other sector saw an increase in March for contract values compared with February. The biggest increase came in medical and health construction, which reached £200 million in March, a significantly higher figure for the sector compared to any other month over the last two years.

Regionally, it was the South East that led all regions with contract award value at 18.5% of the UK total, largely thanks to the £70 million Cumberland Place student accommodation project and the aforementioned Pinewood Studios project. This was followed by the North West with 15.9% of the contract award value and London with a 14.6% share.

Commenting on the figures, Michael Dall, lead economist at Barbour ABI, said: “The continuous decline of infrastructure construction contracts and in particular big ticket infrastructure projects will not help to repair the sliding confidence across the industry, which is masking better growth across the other sectors of the industry, in particular the encouraging figures coming from medical and health construction and the strong growth from residential construction.”