New construction output figures show another fall in output

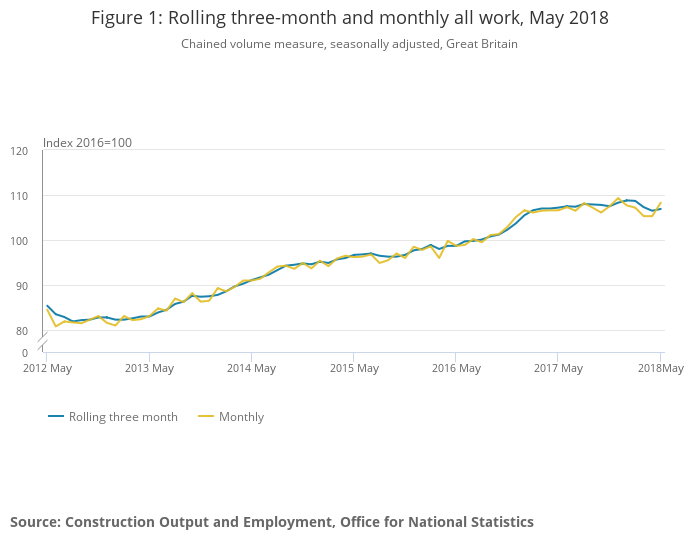

Data published by the Office of National Statistics (ONS) today shows that construction output fell by 1.7% during the three-month on three-month period to May 2018, representing the third consecutive three-month on three-month decline in output in this series. The three-month time series provides a more comprehensive picture of the underlying trends within the industry, compared with the more volatile monthly series, which is also shown in Figure 1.

Following consecutive periods of month-on-month growth in the final two months of 2017, construction output reached a record high. Construction output peaked in December 2017, reaching a level that was 31.5% higher than the lowest point of the last five years, May 2013. Despite a weak start to 2018, construction output has begun to show signs of recovery and, following the growth in May 2018, construction remains 30.3% above the level seen in May 2013.

Main points

- Construction output continued its recent decline in the three-month on three-month series, falling by 1.7% in May 2018; representing the third consecutive decline in this series.

- The three-month on three-month decrease in construction output was driven predominantly by a fall in new work, which also fell for the third consecutive month, decreasing by 2.5% in May 2018.

- Following a broadly negative start to 2018 in the month-on-month series, construction output showed signs of recovery in May 2018, increasing by 2.9% compared with April 2018.

- The month-on-month growth in construction output was in part driven by the recovery of private housing repair and maintenance work, which grew 7.3% in May 2018 following a weak start to the year.

Commenting on the new construction output figures published by the ONS today which show output continuing its recent decline, Michael Thirkettle, chief executive of construction consulting and design agency McBains, said: “Today’s figures make for further depressing reading and show that construction is well and truly mired in the deep waters of recession.

“UK and international companies and investors that are looking to invest in the UK are still struggling to get a read on the post-Brexit destination, meaning a reluctance to commit to new projects.

“In particular, the wages of scarce skilled tradespeople has been rising sharply in recent months and companies will face a further squeeze on labour with the supply of non-UK skilled workers being cut off when the UK leaves the EU – an effect, which coupled with material price increases, is squeezing margins substantially.”