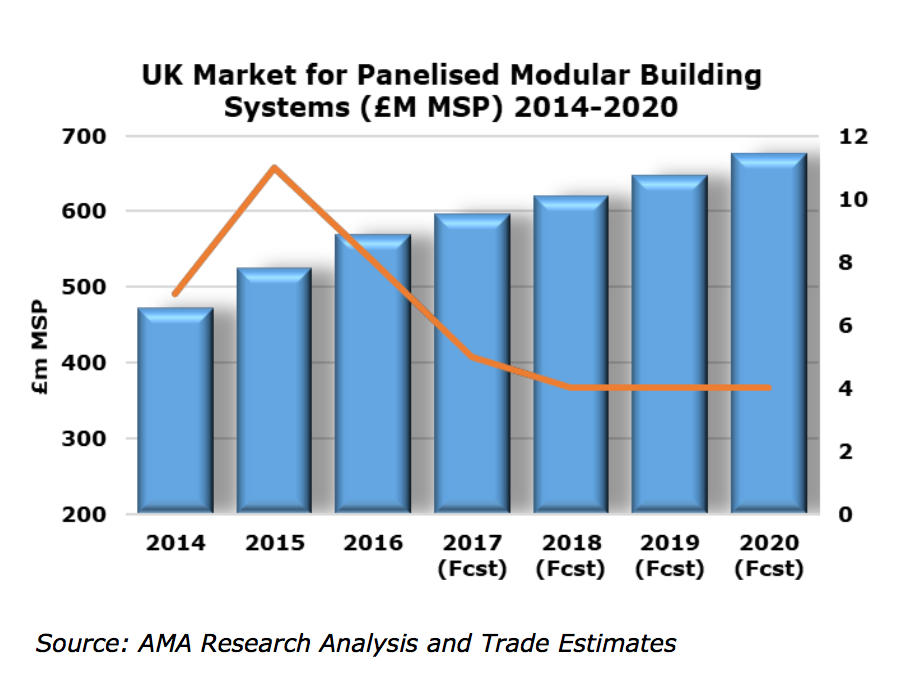

UK market for panelised modular building systems expected to grow 4% per year

The UK market for panelised modular building systems has performed relatively strongly over the past three years or so and is estimated to have grown by 26% between 2014 and 2017. The main product type is timber frame building systems, which is competing with light gauge steel, pre-cast concrete and other engineered wood-based panels, including structural insulated panels (SIPS) and cross laminated timber (CLT) systems. Estimates for 2018 onwards are for 4% growth per year, until 2020.

AMA Research’s definition of the market consists of pre-fabricated, two-dimensional frames or panels in systems for constructing walls, partitions, roofs and floors, typically supplied to site as systems in flat-pack format.

Until 2016, the market for panelised modular building systems had seen steady demand resulting from improving conditions in the overall construction market, particularly in the residential sector, and the market has reportedly benefitted from an improved performance in some key end-use sectors, including education, entertainment, leisure and offices, though more recently, the UK construction market has been less positive.

Several trends have been driving the market for panelised modular building systems. The drive towards sustainable development, coupled with the need to meet energy efficiency and carbon reduction targets, would seem to weigh in favour of off-site construction. Panelised modular buildings are also said to generate less waste, typically have superior airtightness, and hence thermal insulation performance, than brick and block construction.

In terms of product mix, timber frame systems still constitute the largest sector of the panelised building systems market with a share estimated to be around 70%, largely due to a larger supply base and extensive usage in the Scottish housebuilding market as well as the self-build sector. By value, the timber frame market alone was worth over double the three other smaller sub-sectors combined, with light steel frame the largest of the three smaller sub-sectors.

The market has also reportedly benefitted from rapid development of timber engineering, which has resulted in many high-performance engineered timber products coming onto the market, including the likes of cross laminated timber panels and glue laminated timber products. According to AMA research, further growth in these product options may well further stimulate the overall panelised systems market.

Key end-use sectors for panelised modular building systems are private and social housing, apartment blocks, schools, hotels, healthcare and care facilities and purpose-built student accommodation. Residential applications account for around 65–75% of the overall market, reflecting the predominance of timber frame in the building of both private and social housing.

“Over the next few years to 2022, there are several factors that will underpin a steady growth in this sector, probably over and above that forecast across the overall construction industry. These include an increasing use of Building Information Modelling, and an increasing number of public sector procurement frameworks,” said Keith Taylor, director of AMA Research.

“More importantly there is now a strong likelihood of an increase in the use of volumetric and other types of off-site construction methods to help meet the chronic housing shortage and cope with the lack of traditional construction skills within the construction industry.”